39 bond coupon interest rate

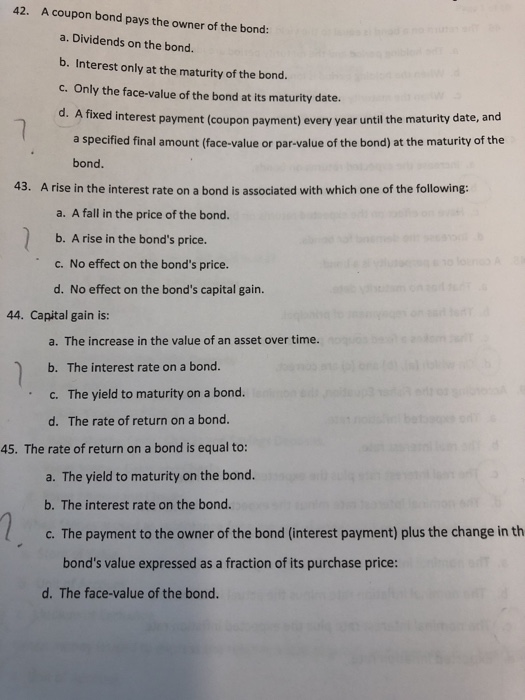

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

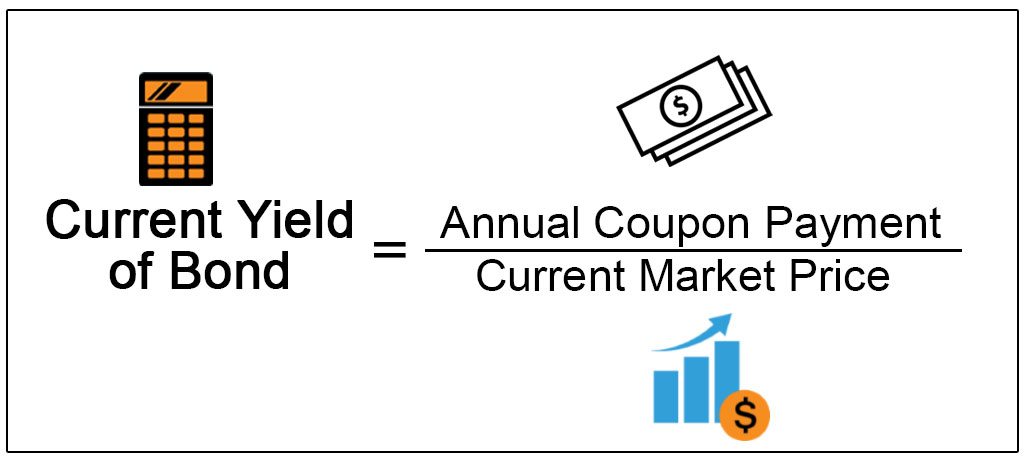

Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of...

Bond coupon interest rate

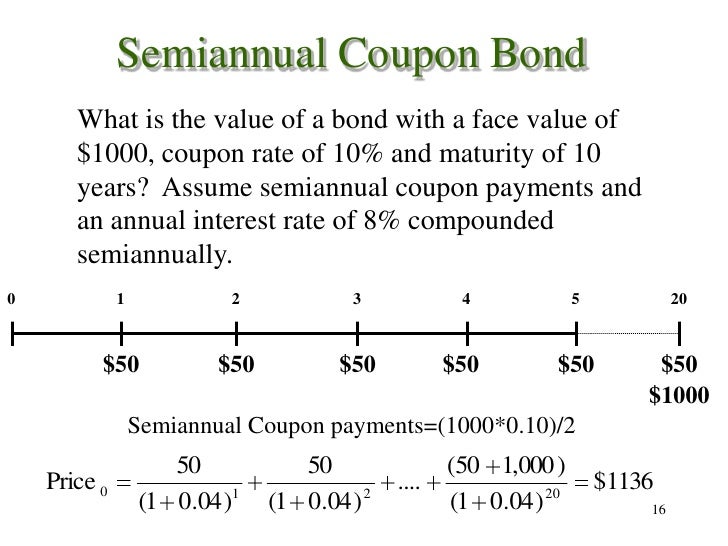

Here's how rising interest rates may affect your bond portfolio Interest rates are rising in 2022 — here are your best money moves. For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ... Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate.

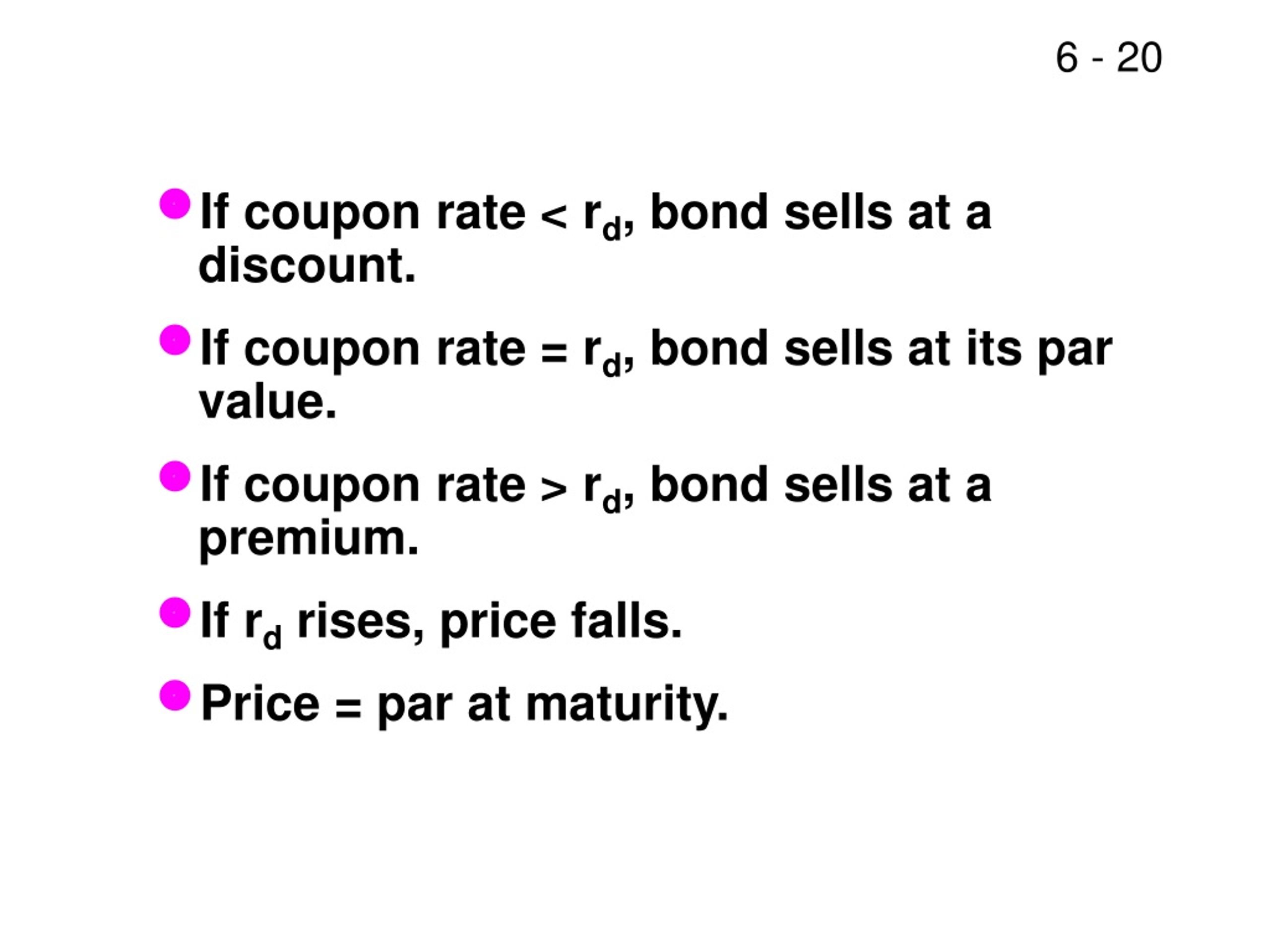

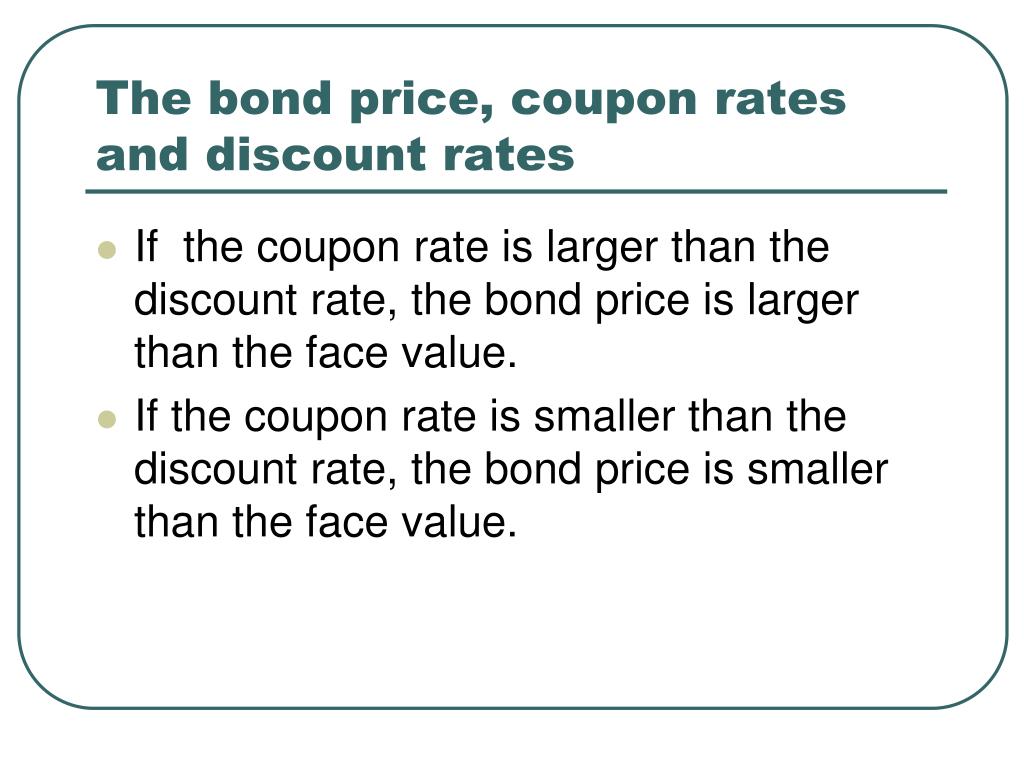

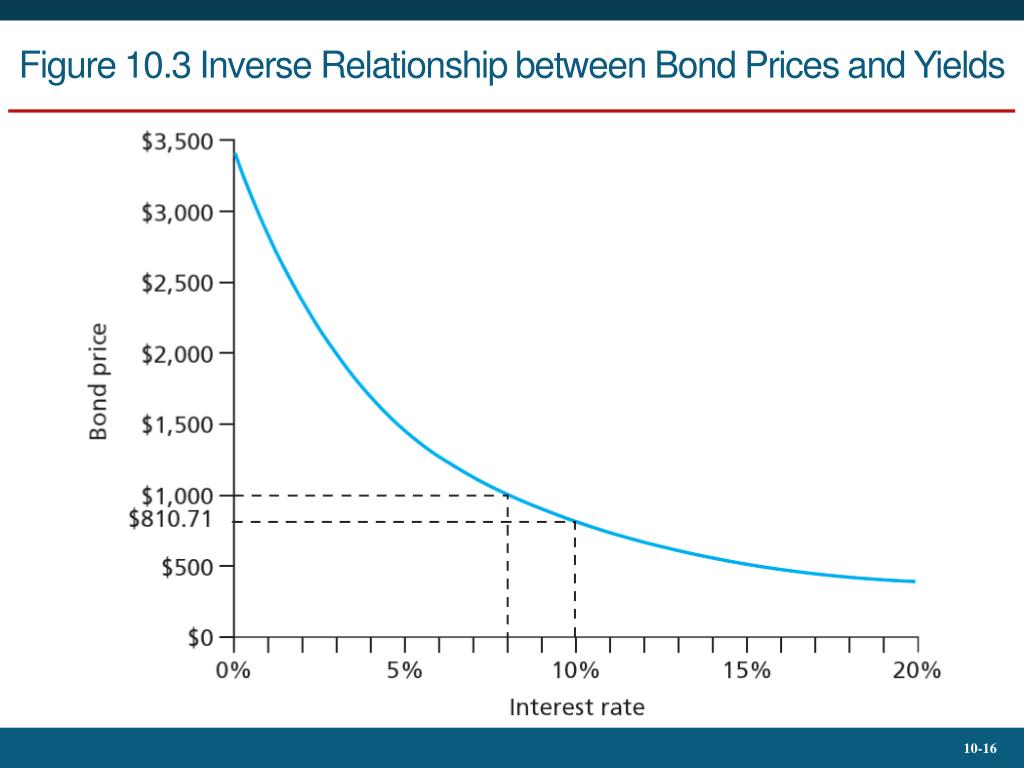

Bond coupon interest rate. Bond Pricing - Formula, How to Calculate a Bond's Price A bond could be sold at a higher price if the intended yield (market interest rate) is lower than the coupon rate. This is because the bondholder will receive coupon payments that are higher than the market interest rate, and will, therefore, pay a premium for the difference. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

Bonds and Interest Rates | FINRA.org The federal funds rate, in turn, influences interest rates throughout the country, including bond coupon rates. Another rate that heavily influences a bond's coupon is the Fed's Discount Rate, which is the rate at which member banks may borrow short-term funds from a Federal Reserve Bank. The Fed directly controls this rate. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 How Are Bond Prices Affected by Coupon Payment Dates? This Treasury bond has a 6% coupon and makes $30 interest payments every Feb. 15 and Aug. 15. You are buying the bond on the 122nd day of a payment period that has 184 days. Accrued Interest Of Coupon Bond Quick and Easy Solution The first coupon payment to the holders of the 2025 Notes at the higher interest rate was paid in January 2021. Following the closing of Southwestern's acquisition of Indigo Natural Resources LLC, S&P upgraded the Company's bond rating to BB ...

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Finance Coupon Rate The coupon rate is the interest that a bond pays when it is issued. For example, a $100,000 bond with a coupon rate of 2.5% will pay $2500 per year. The interest is usually split into several payments throughout the year. Everything You Need To Master Excel Modeling To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

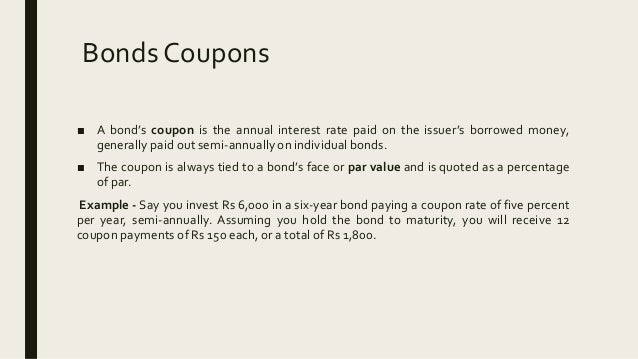

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

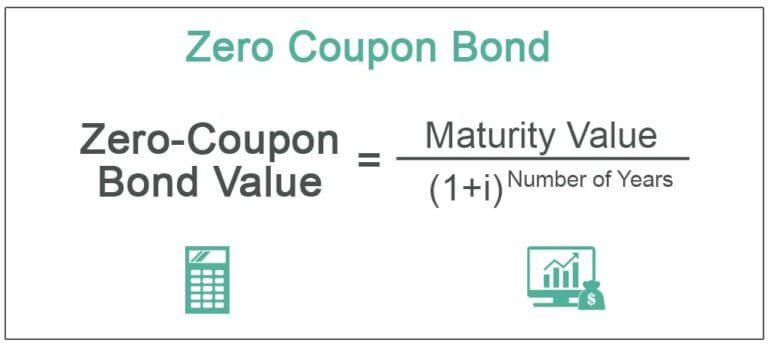

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Series I Savings Bonds Rates & Terms: Calculating Interest Rates NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made. For example, if you buy an I bond on July 1, 2022, the 9. ...

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate.

Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Here's how rising interest rates may affect your bond portfolio Interest rates are rising in 2022 — here are your best money moves. For example, let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ...

Post a Comment for "39 bond coupon interest rate"