44 treasury bill coupon rate

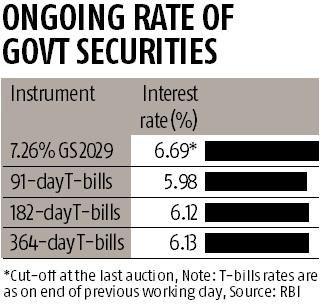

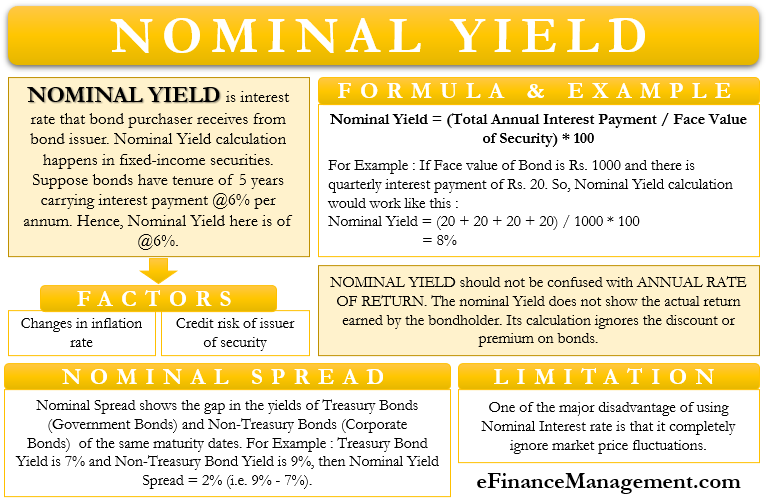

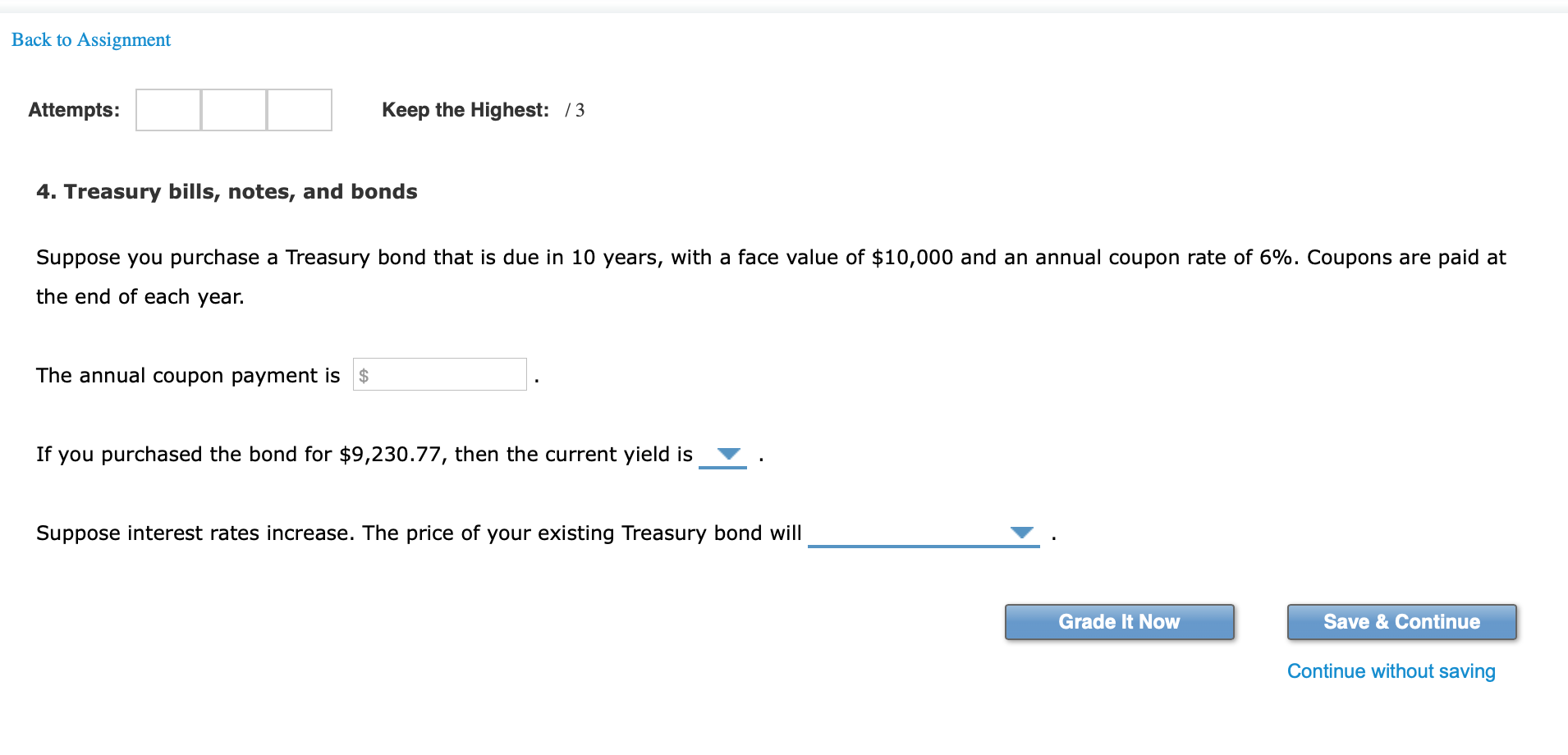

What Are Treasury Bills (T-Bills) and How Do They Work? T-bills are zero-coupon bonds that are usually sold at a discount and the difference between the purchase price and the par amount is your accrued interest. Treasury Bonds: Rates & Terms - TreasuryDirect Sometimes when you buy a bond, you are charged accrued interest, which is the interest the security earned in the current semiannual interest period before you ...

U.S. 10 Year Treasury Note Overview - MarketWatch Open 3.919% · Day Range 3.867 - 3.919 · 52 Week Range 1.341 - 3.928 · Price 90 8/32 · Change 3/32 · Change Percent 0.12% · Coupon Rate 2.750% · Maturity Aug 15, 2032 ...

Treasury bill coupon rate

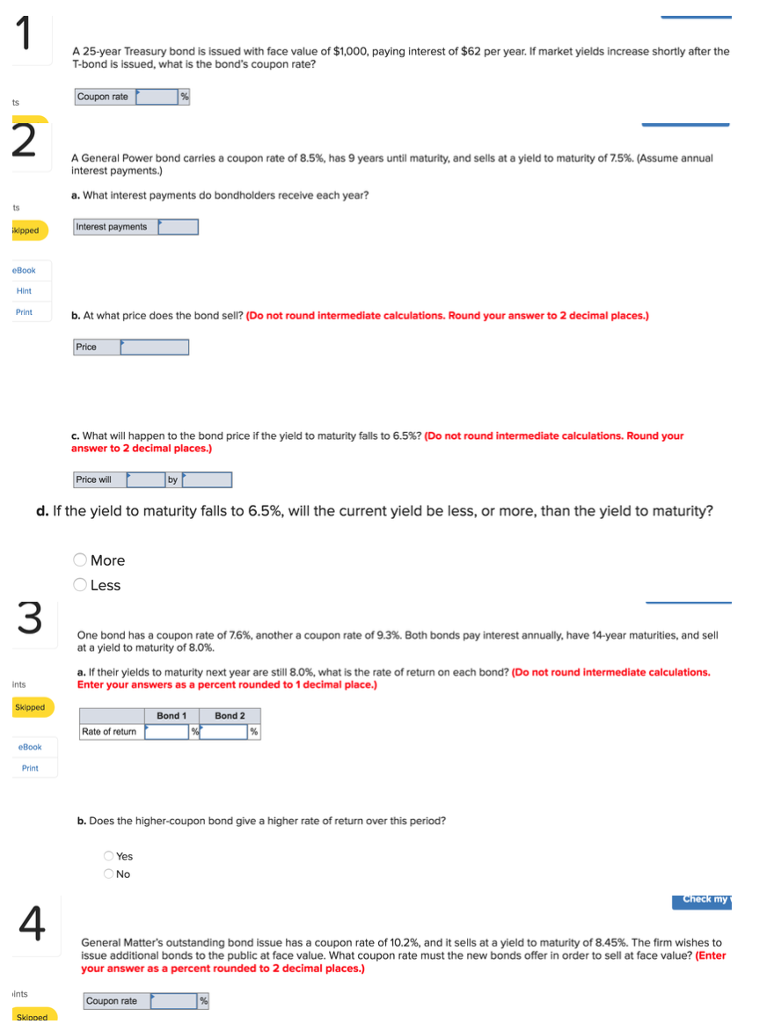

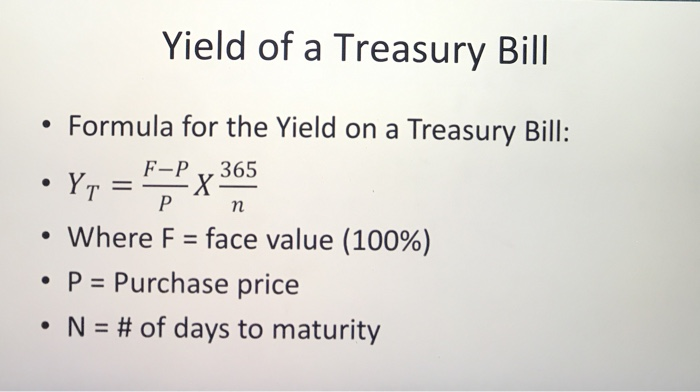

What makes Treasury bill rates rise and fall? What effect ... Treasury bills . Investors consider U.S. Treasury bills (T-bills) to be the safest short-term financial instrument because these debt obligations are perceived to have no default risk. Moreover, because T-bills mature in less than one year--most mature in several months--they do not have a large interest rate risk component, either. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · Coupon Rate Vs. Current Yield . ... A Treasury Bill (T-Bill) is a short-term debt obligation issued by the U.S. Treasury and backed by the U.S. government with a maturity of less than one year.

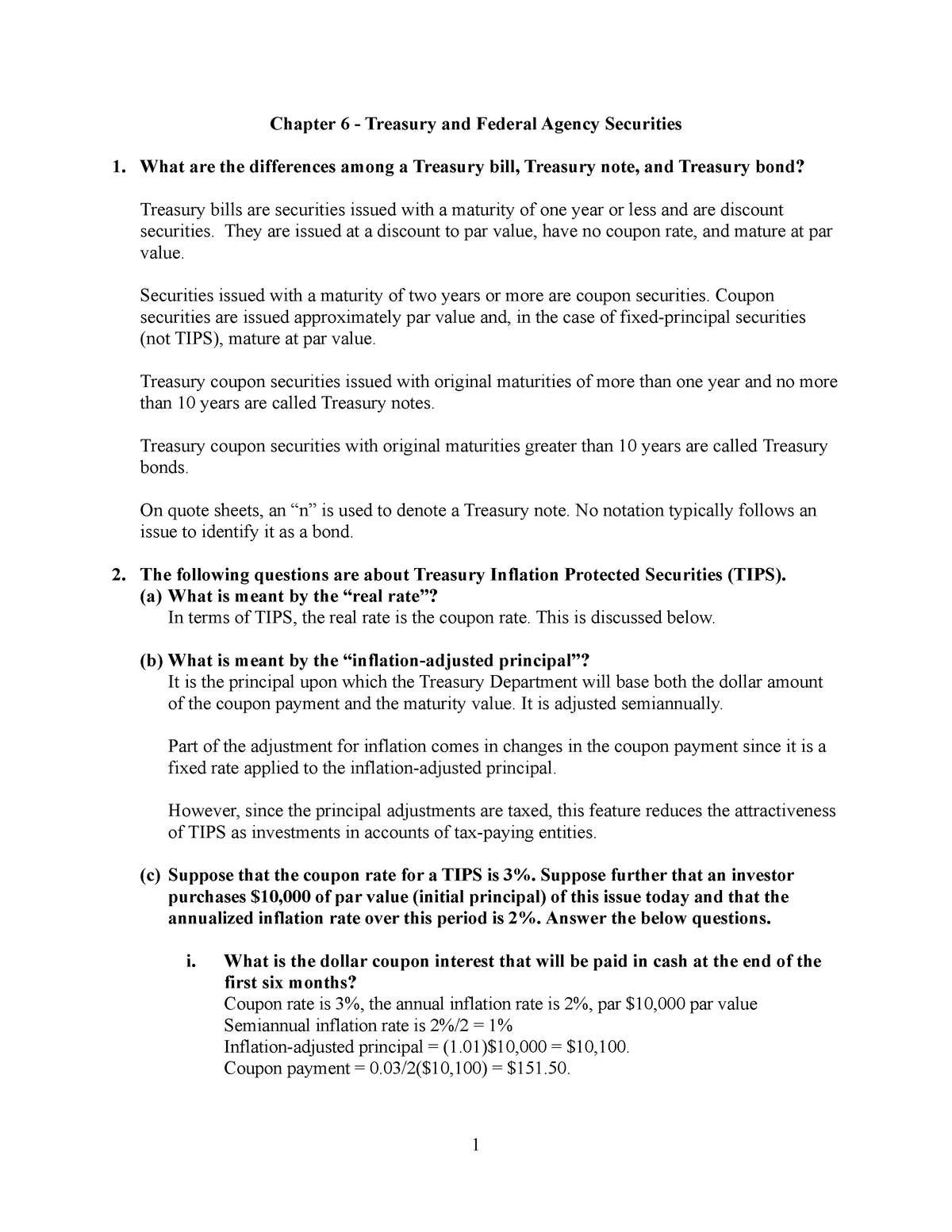

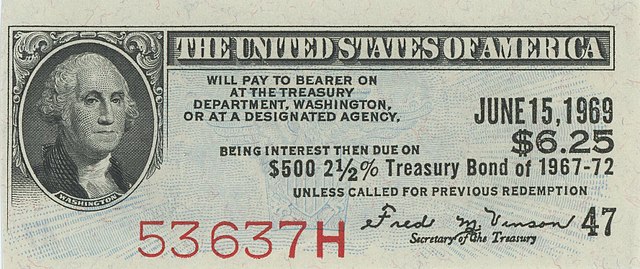

Treasury bill coupon rate. Resource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a : 1.71 : 1.74 : 1.81 Price, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

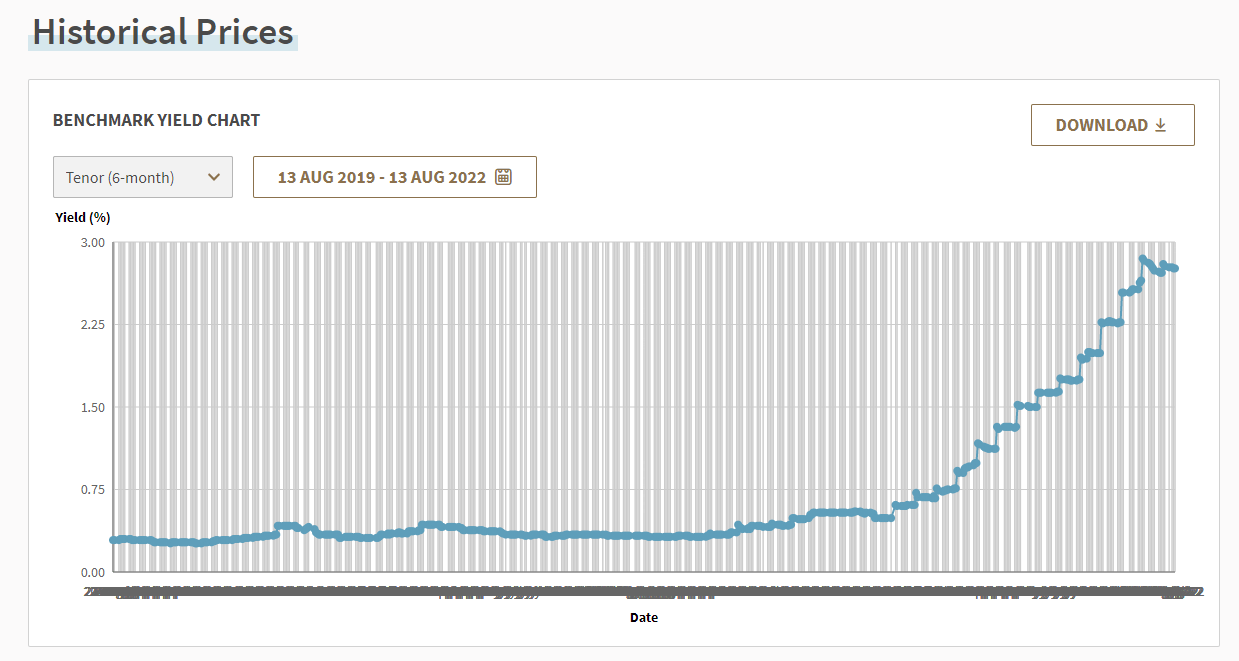

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market ... Understanding Treasury Bond Interest Rates | Bankrate 2 Nov 2021 — Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 ... How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · Coupon Rate Vs. Current Yield . ... A Treasury Bill (T-Bill) is a short-term debt obligation issued by the U.S. Treasury and backed by the U.S. government with a maturity of less than one year. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

What makes Treasury bill rates rise and fall? What effect ... Treasury bills . Investors consider U.S. Treasury bills (T-bills) to be the safest short-term financial instrument because these debt obligations are perceived to have no default risk. Moreover, because T-bills mature in less than one year--most mature in several months--they do not have a large interest rate risk component, either.

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

Post a Comment for "44 treasury bill coupon rate"