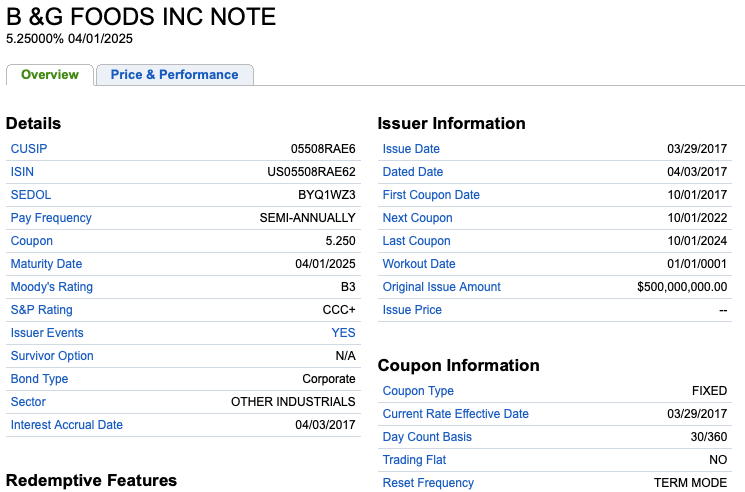

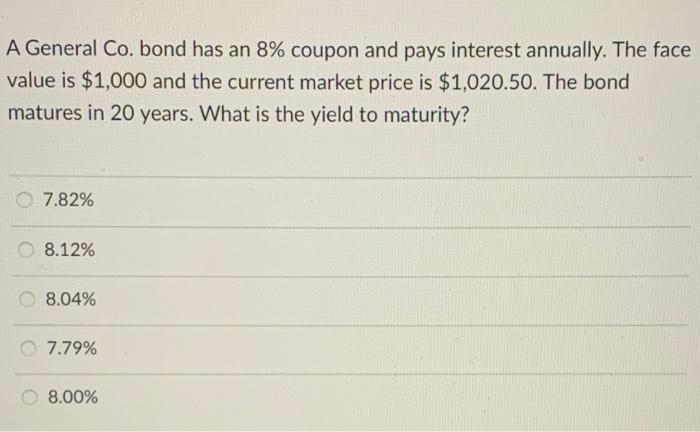

42 a general co bond has an 8% coupon

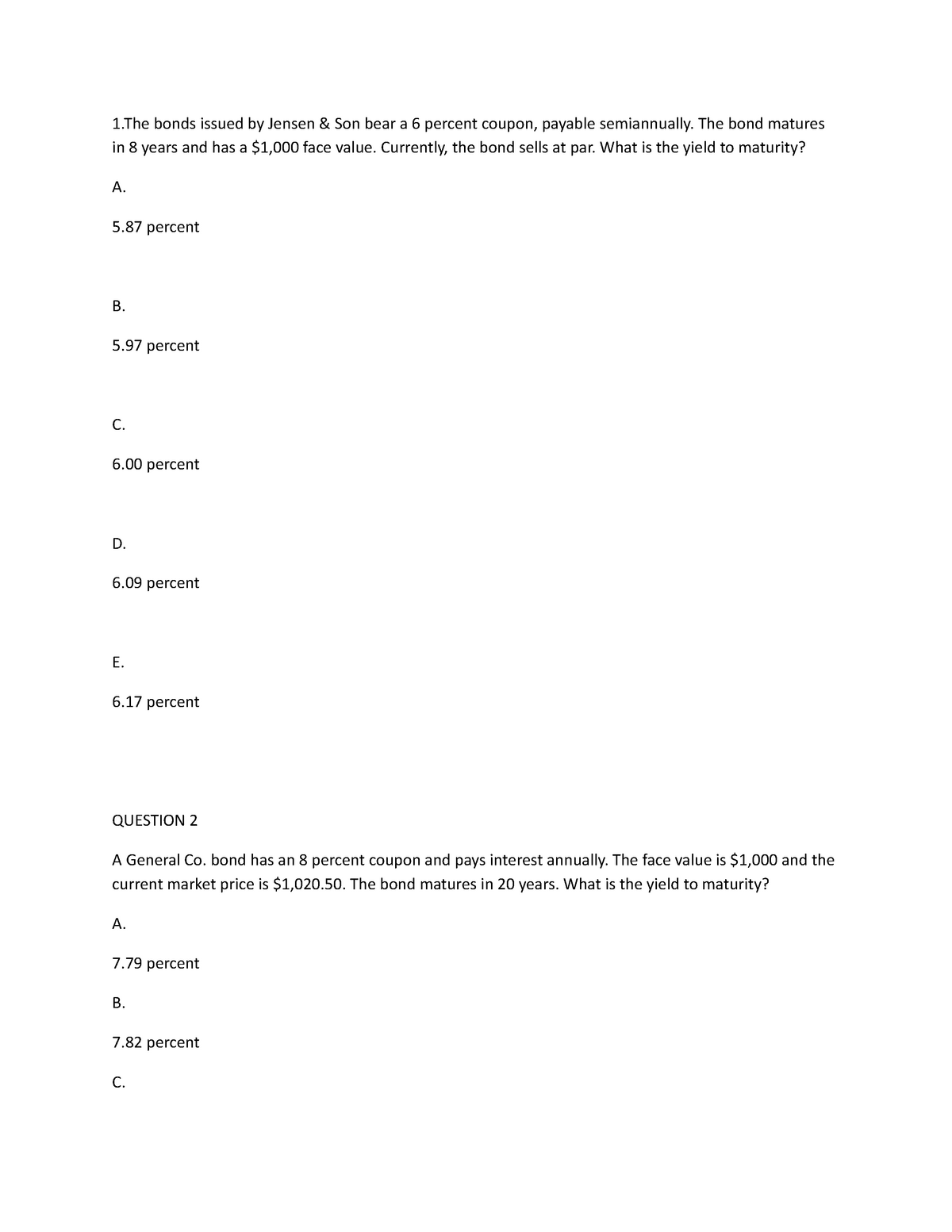

Finance - JustAnswer A General Co. bond has an 8 percent coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in ... FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond pays an annual coupon, its YTM is 8%, and it currently trades at a premium. Which of the following statements is CORRECT? a. If the yield to maturity remains at 8%, then the bond's price will decline over the next year. b. If the yield to maturity increases, then the bond's price will increase. c.

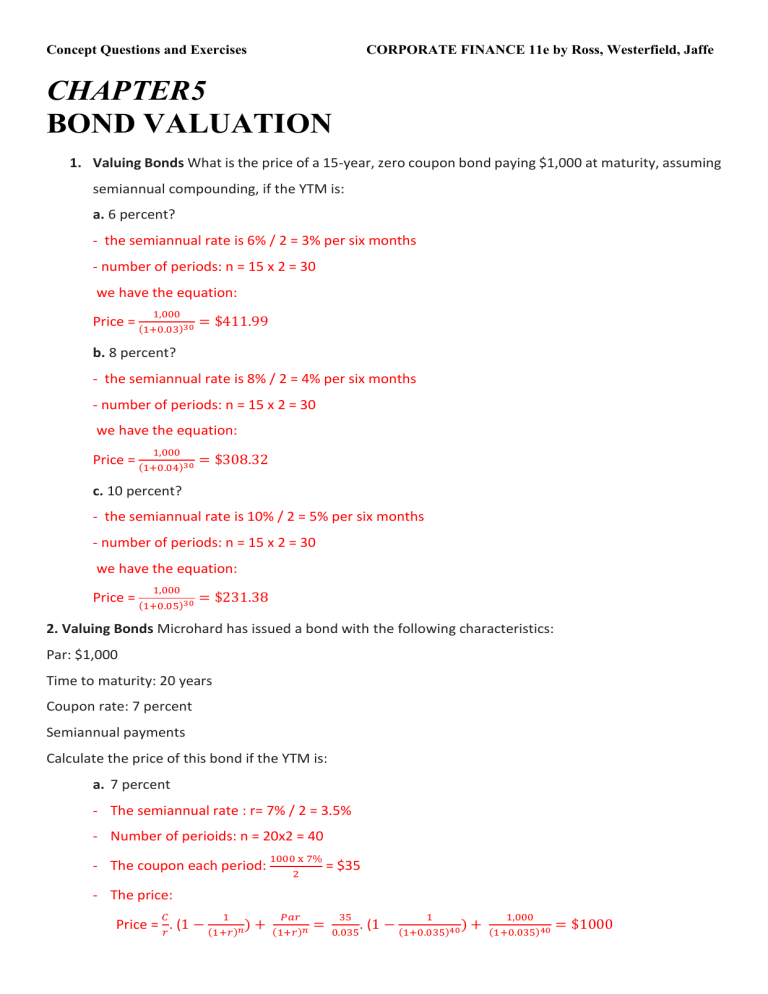

Coupon Bond - Guide, Examples, How Coupon Bonds Work The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources

A general co bond has an 8% coupon

Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means... 1. A General Co. bond has an 8% coupon and pays interest ... Mar 20, 2020 ... 1. A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond ... Bond practice.xlsx - 1. ABC Co. has 9 percent coupon bonds... A General Co. bond has an 8% coupon and pays interest annually. The N 20 I 7.794% PMT 80 FV 1000 Frequency annually PV-1020.50 8. The semiannual, ten-year bonds of Adep, ... The bond has a coupon rate of 8 percent and it pa is bond is 7.25 percent, what is the price of the bond? usiness.

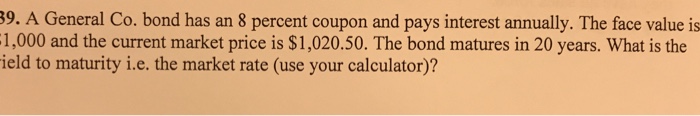

A general co bond has an 8% coupon. A General Co. bond has an 8 % coupon and pays interest annually. A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price Ask an Expert Answers to Homework Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com Question: A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% This problem has been solved! See the answer Show transcribed image text Expert Answer 100% (3 ratings) Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ... A bond has an 8% coupon rate (semi-annual interest), a maturity ... A bond has an 8% coupon rate (semi-annual interest), a maturity value of $1,000, matures in 5 years, and a current price of $1,200. What is this bond's ...

Solved A General Co. bond has an 8% coupon and pays interest - Chegg A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 92% (12 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the … Chapter number 07 Finance Quiz Questions - 1 TRUE/FALSE. Write ... Choose the one alternative that best completes the statement or answers the question. A 10-year, 8% coupon bond pays interest annually. The bond has a face ... Act 5 q15 - home work - 7 Bond Values A Microgates ... - StuDocu Bond Yields BDJ Co. wants to issue new 10-year bonds for some much- needed expansion projects. The company currently has 8 percent coupon bonds on the ... Finance Ch. 5-7 Quiz Questions Flashcards | Quizlet A General Co. bond has a coupon rate of 7 percent and pays interest annually. The face value is $1,000 and the current market price is $1,020.50.

quiz 3 - bond valuation - SU (selviautama) Oct 29, 2011 ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. CF Chp 8 Flashcards | Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?... A general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity.

A General Co. bond has an 8% coupon and pays interest semiannually. The ... A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity?...

A General Co. bond has an 8% coupon and pays interest annually ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,018.50. The bond matures in 15 ...

Bond practice.xlsx - 1. ABC Co. has 9 percent coupon bonds... A General Co. bond has an 8% coupon and pays interest annually. The N 20 I 7.794% PMT 80 FV 1000 Frequency annually PV-1020.50 8. The semiannual, ten-year bonds of Adep, ... The bond has a coupon rate of 8 percent and it pa is bond is 7.25 percent, what is the price of the bond? usiness.

bond prices and returns one bond has a coupon rate of 8 percent another a coupon rate of 12 percent 89223

1. A General Co. bond has an 8% coupon and pays interest ... Mar 20, 2020 ... 1. A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond ...

Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "42 a general co bond has an 8% coupon"