43 yield to maturity of a coupon bond formula

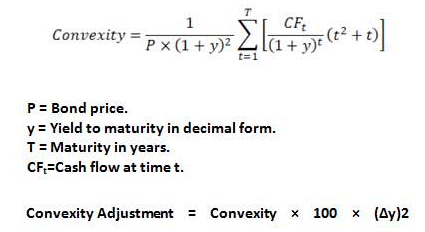

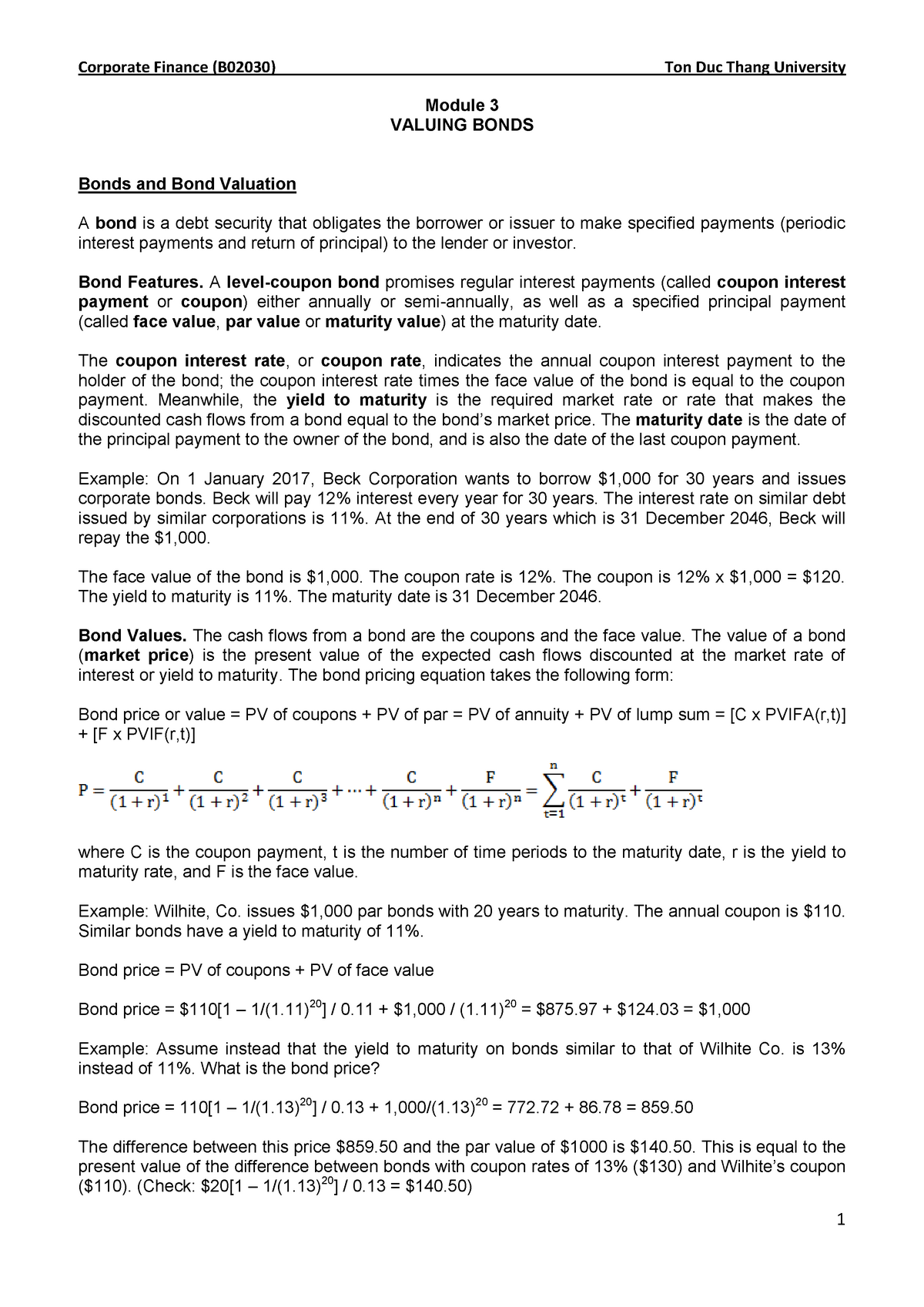

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents Coupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Coupon Frequency: 2x a Year 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25% What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find that answer?

Yield to maturity of a coupon bond formula

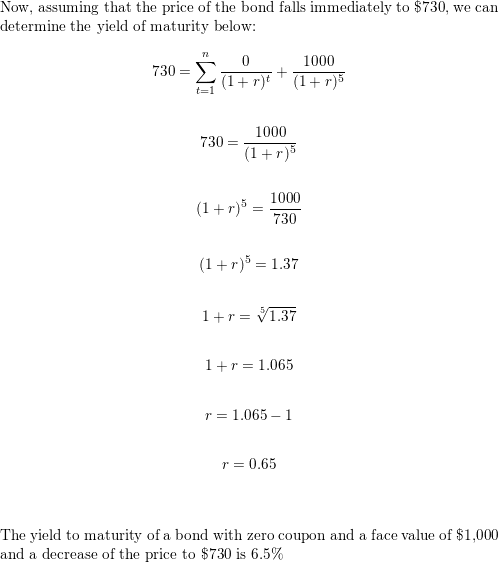

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Ebrary Fourteen-year TIGRS are priced at $250 to yield 10.151% (s.a.). Such problems are easily solved using the time-value-of-money keys on a financial calculator or a spreadsheet program. In this chapter, I work with a 10-year zero-coupon corporate bond that is priced at 60 (percent of par value). Its yield to maturity is 5.174% (s.a.). Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%.

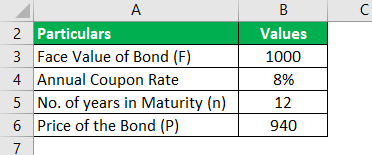

Yield to maturity of a coupon bond formula. Bond yield - Bogleheads The current yield formula is: Current Yield = Annual dollar coupon interest / Price. This formula does not take into account gains or losses if the bond was purchased at a discount or premium. [2] [3] For example: An 18-year, $1,000 par value, 6% coupon bond selling for $700.89 has a current yield of: 8.56% = $1,000 * 6% / $700.89. Yield to Maturity (YTM): Formula and Calculator - Wall Street Prep In our hypothetical scenario, the following assumptions regarding the bond will be used to calculate the yield-to-maturity (YTM). Face Value of Bond (FV) = $1,000 Annual Coupon Rate (%) = 6.0% Number of Years to Maturity = 10 Years Price of Bond (PV) = $1,050 We'll also assume that the bond issues semi-annual coupon payments. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ... Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%. Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator ... The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; ... In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year.

Bond Equivalent Yield | Formula, Example, Analysis, Conclusion In such cases, the investor returns will be the difference between the purchase price of the deep discount or zero-coupon bond and its maturity value. BEY is primarily used to calculate the value of such deep discount or zero-coupon bonds on an annualized basis. Bond Equivalent Yield Formula. d = days to maturity Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. To calculate YTM here, the cash flows must be determined first. Every six months...

how to calculate bond yield to maturity in excel? Time to Maturity = (Coupon Rate / Current Market Value) x Number of Years to Maturity For example, let's say you have a $1,000 bond with a 5% coupon rate that matures in 10 years. The current market value of the bond is $950. Using the formula above, we get: Time to Maturity = (5% / 950) x 10 years = 0.526 years ≈ 6 months

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Here's another example that clearly ...

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

Yield to maturity formula - kgdza.incisione.info 2020. 9. 15. · The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity (YTM ...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Bond Current Yield Calculator Of course, you can also calculate it using our bond price calculator. Use the bond current yield formula. Last, but not least, we can find the final result using the bond current yield formula below: bond current yield = annual coupon / bond price. For our example, the bond current yield of Bond A is $50 / $900 = 5.56%.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%.

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Ebrary Fourteen-year TIGRS are priced at $250 to yield 10.151% (s.a.). Such problems are easily solved using the time-value-of-money keys on a financial calculator or a spreadsheet program. In this chapter, I work with a 10-year zero-coupon corporate bond that is priced at 60 (percent of par value). Its yield to maturity is 5.174% (s.a.).

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "43 yield to maturity of a coupon bond formula"