45 difference between coupon rate and market rate

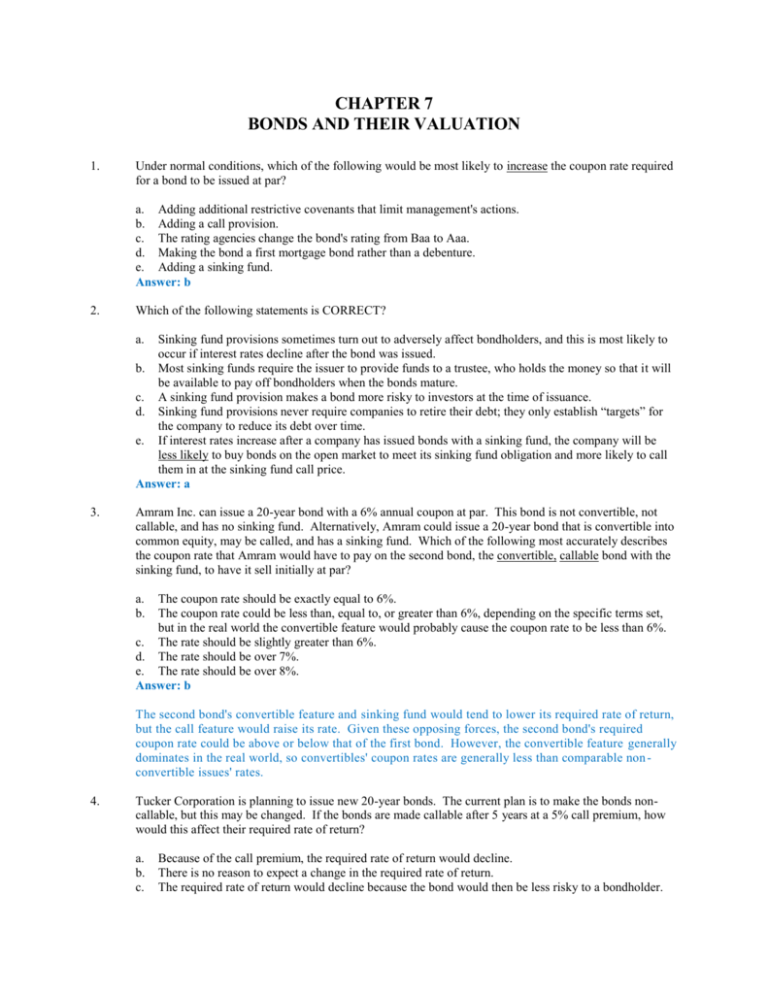

Market Rate Vs Coupon Rate - bizimkonak.com The Difference between a Coupon and Market Rate. CODES (2 days ago) Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder ... Discount Rate vs Interest Rate | 7 Best Difference (with It is set by the Federal Reserve Bank, not determined by the market rate of interest. An interest rate is an amount charged by a lender to a borrower for the use of assets. Interest rates are mostly calculated on an annual basis, which is also known as the annual percentage rate. ... Below is the top 7 difference between Discount Rate vs ...

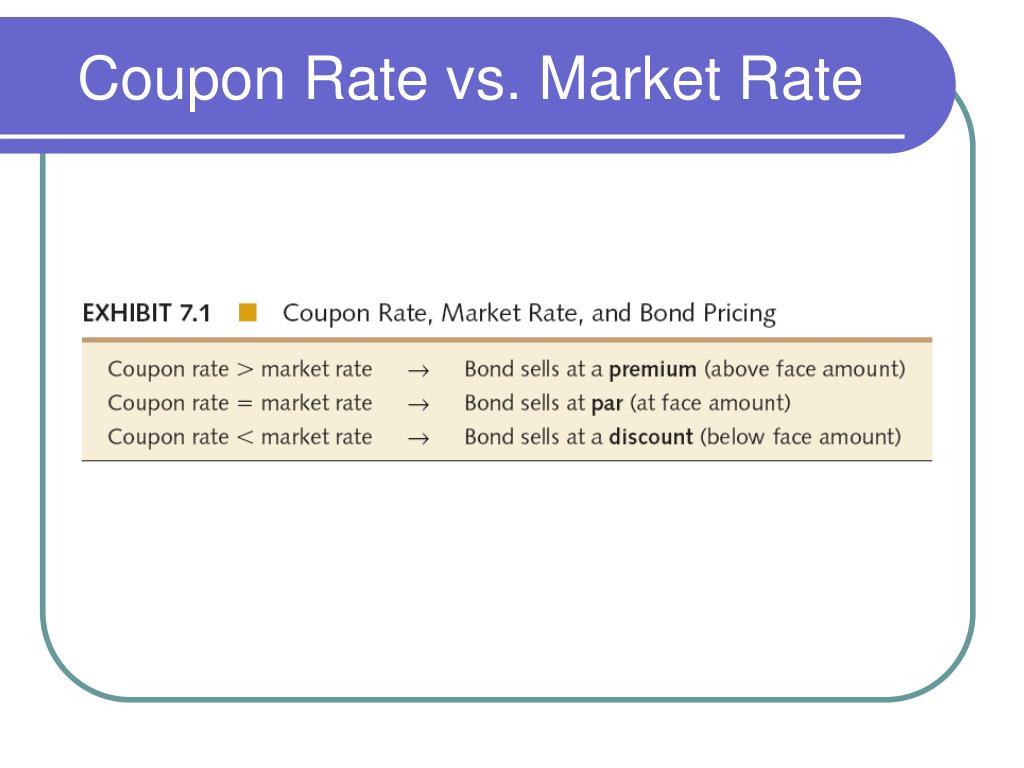

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Difference between coupon rate and market rate

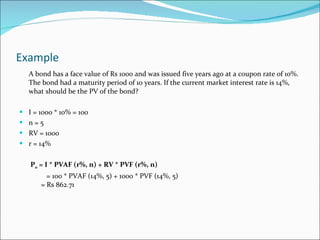

Difference between YTM and Coupon Rates where "Coupon Payment" is the periodic interest payment made by the issuer, "Par Value" is the face value of the bond that's paid at maturity, "Market Price" is the current price of the bond, and "n" is the number of years until maturity. What is the Coupon Rate? What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

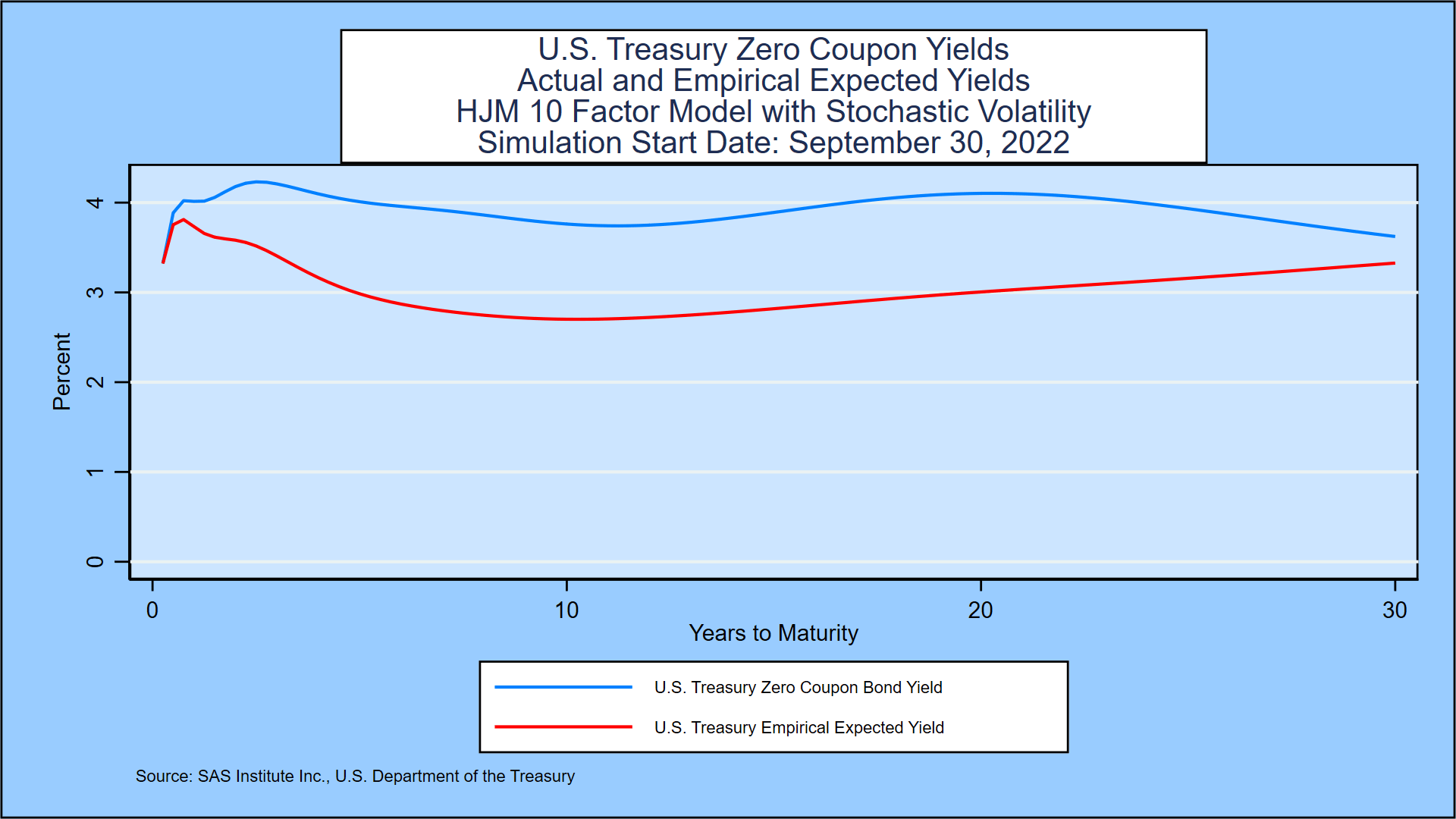

Difference between coupon rate and market rate. Coupon Rate Definition - Investopedia Market interest rates change over time and as they move lower or higher than a bond's coupon rate, the value of the bond increases or decreases, respectively. Since a bond's coupon rate is fixed... What is the difference between the coupon rate and market rate? What is the difference between the coupon rate and market rate? A. NSWER . Paper Title: What is the difference between the coupon rate and market rate? No. of Words: 539 : PRICE: $5.00: User Ratings: Pages: 2.156: Submitted by: professor valin Finance. Student Name ... Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. On the other hand, the Coupon rate is generally associated with debt ... All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads,

Difference Between Coupon Rate and Interest Rate Coupon rate of a fixed term security such as bond is the amount of yield paid annually that expresses as a percentage of the par value of the bond. In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. Discount Rate vs Interest Rate | Top 7 Differences (with … Discount Rate vs. Interest Rate Key Differences. The followings are the key differences between Discount Rate vs. Interest Rate: The use of discount rate is complex compared to the interest rate as the discount rate is used in discounted cash flow analysis for calculating the present value of future cash flows over a period of time, whereas the interest rate is generally … Bonds - Coupon and Market Rates Differ - YouTube Lesson discussing how the value of a bond changes when coupon rates and market rates differ. Looks at why a bond will trade at a premium, discount, or at pa... Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Difference Between Discount Rate and Interest Rate Interest rates and discount rates are rates that apply to borrowers and savers who pay or receive interest for savings or loans. Interest rates are determined by the market interest rate and other factors that need to be considered, especially, when lending funds. Discount rates refer to two different things. While discount rates are the rates ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to rise in price. If the general interest rate is 3% but the coupon is 5%, investors rush to purchase the... Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ... Coupon Rate vs Interest Rate | Top 8 Best Differences Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the …

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond.

What is Repo Rate & Reverse Repo Rate? Meaning, Difference Mar 26, 2021 · What is the repo rate and reverse repo rate in India currently? The current repo rate in India sits at 5.40% as per the 5th August 2022 update, and the reverse repo rate sits unchanged at 3.35%. Who decides the value of the reverse repo rate?

Interest - Wikipedia In economics, the rate of interest is the price of credit, and it plays the role of the cost of capital. In a free market economy, interest rates are subject to the law of supply and demand of the money supply, and one explanation of the tendency of interest rates to be generally greater than zero is the scarcity of loanable funds.

Forward Rate vs. Spot Rate: What's the Difference? - Investopedia Jun 30, 2022 · The restaurant has an immediate business need and must pay the current market price in exchange for the goods to be delivered on time. ... The difference between the spot rate and forward rate is ...

What is the difference between the coupon rate and the market interest ... The coupon rate on the bond is the amount that is listed on the face of the bond. The market rate is the rate that is paid on the open market and will constantly change due to things like global events, company events, and other economic issues. Let me know if you need anything else. If not, please leave a rating. Thanks!

Contract for difference - Wikipedia In finance, a contract for difference (CFD) is a legally binding agreement that creates, defines, and governs mutual rights and obligations between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time. If the closing trade price is higher than the opening ...

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money.

Difference between YTM and Coupon Rates where "Coupon Payment" is the periodic interest payment made by the issuer, "Par Value" is the face value of the bond that's paid at maturity, "Market Price" is the current price of the bond, and "n" is the number of years until maturity. What is the Coupon Rate?

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "45 difference between coupon rate and market rate"